Welcome back to This Week in Apps, the weekly TechCrunch series that recaps the latest in mobile OS news, mobile applications and the overall app economy.

The app industry continues to grow, with a record number of downloads and consumer spending across both the iOS and Google Play stores combined in 2021, according to the latest year-end reports. App Annie says global spending across iOS, Google Play and third-party Android app stores in China grew 19% in 2021 to reach $170 billion. Downloads of apps also grew by 5%, reaching 230 billion in 2021, and mobile ad spend grew 23% year-over-year to reach $295 billion.

In addition, consumers are spending more time in apps than ever before — even topping the time they spend watching TV, in some cases. The average American watches 3.1 hours of TV per day, for example, but in 2021, they spent 4.1 hours on their mobile device. And they’re not even the world’s heaviest mobile users. In markets like Brazil, Indonesia and South Korea, users surpassed five hours per day in mobile apps in 2021.

Apps aren’t just a way to pass idle hours, either. They can grow to become huge businesses. In 2021, 233 apps and games generated more than $100 million in consumer spend, and 13 topped $1 billion in revenue. This was up 20% from 2020 when 193 apps and games topped $100 million in annual consumer spend, and just eight apps topped $1 billion.

This Week in Apps offers a way to keep up with this fast-moving industry in one place with the latest from the world of apps, including news, updates, startup fundings, mergers and acquisitions, and suggestions about new apps and games to try, too.

Do you want This Week in Apps in your inbox every Saturday? Sign up here: techcrunch.com/newsletters

Apple’s iOS privacy changes & competition catch up with Facebook, err Meta

Image Credits: TechCrunch

While it may be a hair too soon to say it’s the beginning of the end of Facebook, the social giant now called Meta is finally starting to feel the combined impacts of a number of challenges hitting all at once. On top of the ongoing issues over content moderation and the general harms of social media — as the world was alerted to by whistleblower Frances Haugen — the company, at last, also has a formidable threat to its future in the form of TikTok. The short-form video app has managed to do the seemingly impossible: stop Facebook’s growth and cut into its ads business. In its Q4 2021 earnings, Facebook reported its first-ever loss in daily active users, from 1.93 billion in Q3 to 1.929 billion in Q4. Those are still mind-blowing user numbers to be sure, but it’s the first real hint as to how Facebook’s inability to reach the younger generation and competition from TikTok could be stalling its growth. In addition, Meta’s family of apps (FB, Instagram, Messenger and WhatsApp) reported slower growth than in past quarters, from 2.81 billion to 2.82 billion.

Meanwhile, Meta is attempting to navigate a future to some sort of immersive “metaverse” that won’t be realized for perhaps a decade, while also trying to fend off the TikTok threat. CEO Mark Zuckerberg told staff to focus on Reels and other video projects, even as the company is simultaneously building out features with the metaverse in mind — like cross-platform avatars. TikTok isn’t just taking away users, it’s eating into Meta’s revenue. The company reported $10.3 billion in profit in the quarter, and EPS of $3.67, falling short of Wall Street’s expectation of $3.84. And it reported Q1 revenue guidance of $27-29 billion, down from Q4’s $33.67 billion. That’s not all TikTok’s fault, of course, Meta plainly said that Apple’s privacy changes introduced last year already cost it $10 billion in lost sales during 2021.

But even Apple can’t be fully at fault here. Both Snap and Pinterest have more nimbly weathered the disruption caused by the iOS privacy changes, according to their own earnings and the accompanying stock recoveries. (Snap even turned its first net profit.)

What’s ultimately the issue is that Meta lacks diversified revenue streams — ads account for 98% of its revenue. For example, despite being a longtime home for creators, Meta is only now spinning up new efforts to cash in on those economies through things like tips and subscriptions. Instagram’s subscriptions are just entering tests. Meta also started to dabble in web3 and NFTs, but has little to nothing to show for those efforts. It even had to shut down its cryptocurrency project. Meanwhile, when Meta has expanded into new areas — like VR-based gaming or e-commerce — it has done so with an eye on how those are tied to social networking products, including key apps like Facebook and Instagram. So if Meta’s grip on social begins to trend downwards, it could impact the rest of its business in the process.

The Open App Markets Act moves forward

A bill that could force Apple and Google to allow third-party app stores, sideloading and alternative payments, aka the Open App Markets Act, won Senate Judiciary Committee approval this week after gathering bipartisan support. It’s also a great example as to why the tech giants should have never let things get to the point of needing regulators to step in to even the playing field, as the bill in its present form is not really a win for either consumers or smaller developers in its present form.

Apple has aggressively fought against this legislation, making valid points that opening up mobile devices to sideloading could increase the risk of “malware, scams, and data-exploitation,” or so the company argued in a letter sent to Senate Judiciary Chair Dick Durbin and ranking Republican Chuck Grassley. Plus, Apple pointed out how sideloading could help “big media platforms” avoid the consumer privacy protections it’s added to its platform.

Not all developers are on board with the bill. The Coalition for App Fairness — which counts Match, Epic Games and Spotify among its members — backs the legislation. But another trade group representing small companies in the app economy, The App Association, wrote a letter to Durbin and Grassley stating their opposition to the bill due to the security and privacy issues it could introduce, among other things.

But the bill won’t likely become law without a number of changes. In early debates, for example, some senators raised concerns over the privacy impacts and unintended consequences of allowing a path for apps promoting hate speech to find their way onto consumer devices. The bill has also already been amended to make it more clear what sort of security considerations the app stores can take without violating the law.

Apple

- The iOS 15.4 beta added support for web app push notifications as well as other hints about AR/VR features. The current speculation is that Apple is preparing to support its upcoming goggles or headsets, not necessarily third-party AR or VR devices already on the market.

- An app developer’s lawsuit over App Store rejections and scams is able to proceed, a judge ruled. Instead of trying to make antitrust claims, the developer, Kosta Eleftheriou, is focused on issues like lost revenue over the inconsistent App Store Review process and having to compete with scammers who use fake ratings to boost their competitive apps.

Platforms: Google

- During its Q4 2021 earnings, Google said its Pixel phones — the Pixel 6 and 6 Pro — just had their best sales quarter ever, noting the phones were popular with consumers and carriers alike. The company didn’t break out the actual sales numbers, however. They’re tracked in the company’s “Other” category, which covers all hardware and other things outside its core businesses. The category grew 22% year-over-year to reach $8.2 billion.

Augmented Reality

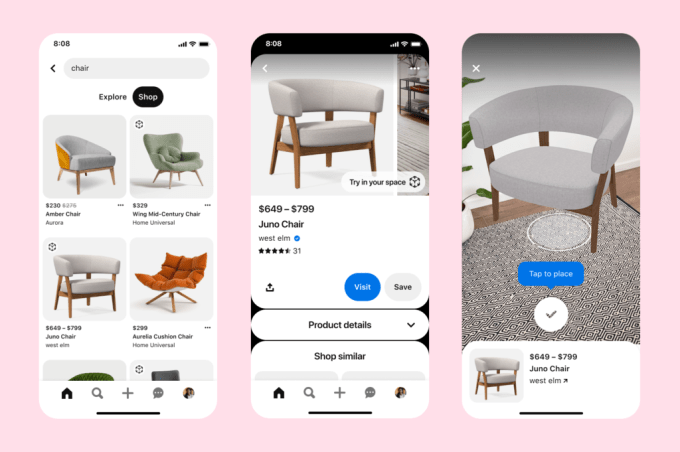

Image Credits: Pinterest

- Pinterest expanded its AR shopping feature to include furniture and home décor. The company is working with a select group of U.S. retailers, including Crate & Barrel, Walmart, West Elm and Wayfair, to allow online shoppers to virtually place items in their home using the Pinterest app’s “Lens camera.” If the user then likes what they see, they can proceed to purchase the item directly from the retailer.

E-commerce

- TikTok commerce is popping. The company released some crazy stats at its creator event this week, including one metric that claimed 48% of TikTok users immediately purchased a product they saw on the platform.

Fintech/Crypto

- PayPal’s stock dropped 25% immediately after its mixed Q4 2021 earnings on the company’s weak full-year revenue growth guidance for 2022. PayPal saw $1.11 EPS versus $1.12 expected and revenue of $6.92 billion versus $6.87 billion, expected. However, the company missed its prior target on net new active accounts for the quarter — which it partially blamed on illegitimate accounts that joined during incentive-based campaigns but weren’t included in the totals. PayPal’s customer base today is 426 million, and it expects to add 15-20 million more users this year — but not the total of 750 million accounts it had set last year. There are a number of factors at play here, like COVID and competition, but there’s also this: Has anyone seen its apps? The PayPal and Venmo apps keep getting makeovers and new features but they don’t look good. They don’t look modern. Navigation is a mess. Iconography looks dated. They’re shoehorning in crypto and credit cards and other aspects of the business that makes PayPal money at the expense of the end-user experience.

- Personalized video app Cameo, which lets fans connect with celebs, launched Cameo Pass, an NFT-based community on OpenSea that claims to offer “exclusive access” to celebrity Q&As, meet and greets, and launch parties.

Social

- Snap reported its first-ever quarterly net profit as a public company in Q4 2021, with revenue of $1.3 billion, up 42% year-over-year and net income of $23 million. The app maker said it was able to recover sooner than expected from the advertising revenue hit prompted by Apple’s privacy changes. For the full year, revenue grew 64%, to $4.1 billion. The stock popped 60%+ on the news of the app’s success. The company expects DAUs between 328 million and 330 million in the first quarter, above analyst estimates.

- Pinterest also had a decent quarter, with Q4 revenue of $847 million, up 20%, and full-year revenue topping $2 billion, up 52% year-over-year. The company said this was its first full year of GAAP profitability. One downside, however, was a 6% decline in global MAUs, to 431 million, with the largest drop coming from the key U.S. market (down 12% to 86 million). But the stock jumped 28%+ on the solid performance and revenue outlook in line with consensus. Both Snap and Pinterest had seen their stocks sink after Meta’s poor Q4 performance ahead of their own earnings.

- TikTok added a portal on its Discover page this past week in honor of International Holocaust Remembrance Day designed to educate users about the historic catastrophe, as well as the ongoing threat of antisemitism. The company will also now display a banner when users search terms like “Holocaust” or “Holocaust survivor” on TikTok, that will prompt them to visit a multilingual website about the Holocaust. In the coming months, TikTok will add a similar notice as a permanent banner on videos about the Holocaust, it says.

- Continuing its focus on the metaverse, Meta brought its 3D avatars to Instagram and is also rolling out updated avatars to Facebook and Messenger. Users in the United States, Canada and Mexico can now show up as their virtual selves in stickers, feed posts, Facebook profile pictures and more. The company also improved the look of avatars by adjusting facial shapes to make them appear more authentic.

Image Credits: Meta

- South Korea’s Naver Group, which develops the 3D avatar app Zepeto, has pledged $100 million to fund creators and studios that use its new Unity plugin to create 3D experiences for the app. Creators will be rewarded based on plays, visits and active users of their 3D features. The app now has 20 million MAUs.

- Twitter expanded a test that’s trying out the idea of downvotes in addition to hearts (“Likes”) to serve as a signal to its ranking algorithms. The idea is that users could anonymously downvote replies they found offensive or irrelevant to the conversation, which could in turn serve to boost the quality of the conversation on the platform. The initial test had been only for English-speaking audiences. Now Twitter is testing the feature globally, but still with a select group of users, not all users worldwide.

Messaging

- Google’s Message app rolled out support for iMessage reactions into beta. With the update, Tapbacks sent by iPhone users will be converted to emojis that appear in the bottom-right corner of your message bubble, similar to iOS. The conversions aren’t exactly one-to-one, however, as Heart becomes the smiling face with heart eyes and Haha becomes the face with tears of joy. But that’s because Google is mapping its emoji to RCS reactions.

- Telegram’s latest update added easy-to-create video stickers (including the ability to import stickers from other apps), plus better reactions with compact animations and extra emoji, a button to review unseen reactions and improved navigation between chats.

- Messenger added new effects to celebrate Lunar New Year with a chat theme and sticker pack designed by graphic designer and illustrator Naomi Otsu, as well as a Lion Dance group effect and 3D Avatar stickers.

Streaming & Entertainment

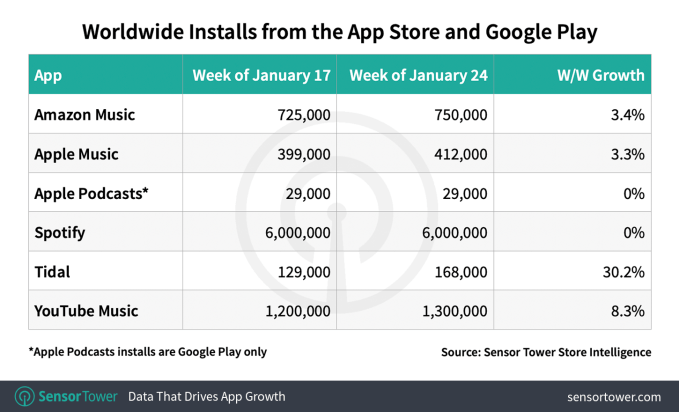

- The Spotify backlash over Joe Rogan has been a PR nightmare for the service, but it hasn’t yet substantially boosted downloads for Spotify’s competitors, per Sensor Tower data. The service that saw the largest change, percentage-wise, was Tidal, which grew installs 30.23%, from 129,000 during the week of January 17, 2022, to 168,000 during the week of January 24. But by raw numbers, it’s not that big of an increase when compared with the 6 million new weekly downloads Spotify saw during this time. Meanwhile, Amazon Music grew installs by 3.4%, Apple Music by 3.3% and YouTube Music by 8.3%. Of those, only YouTube Music is even in the seven-digit range in terms of weekly new installs. It added 1.3 million installs during the week of January 24, while Spotify saw 6 million installs — a figure down 9.10% from the week prior, when it saw 6.6 million. In other words, a decline in new installs…but still a lot of them.

Image Credits: Sensor Tower

- Spotify also reported its earnings this week with Q4 2021 revenue (before the Joe Rogan PR crisis) of €2.69B, up 24% year-over-year and 406 million MAUs, up 18% year-over-year. Its ad-supported revenue was €394 million, up 40% year-over-year and hit a record 15% of total revenue. Spotify’s podcast library grew to 3.6 million in Q4, up from 3.2 million in the prior quarter. However, the company forecast slowed subscriber growth in Q1 2022 of 183 million paying users, but added it was too early to know what sort of churn it would see from cancellations at this point. The company currently has 180 million paying users but only saw ARPU growth of 3% year-over-year.

- Twitch’s mobile app has now become the 19th non-gaming app to join the billion-dollar club, reports App Annie. The top markets driving the lifetime spend figure include the U.S., U.K., Germany, Canada, France, Australia, South Korea, Italy, Mexico and Spain. In 2021, Twitch’s app broke into the top 10 non-gaming apps by annual consumer spend for the first time, up two ranks from 2020 to reach the No. 9 spot.

- Snapchat secured multi-year renewals on global content deals with several big media companies, including Disney, NBCUniversal and ViacomCBS. The deals allow the companies to continue their collaboration with Snapchat to provide shows for the app’s Discover page, including the renewals of many existing shows and the launch of new ones across brands like ESPN, MTV, Awesomeness, CMT, VH1, Bravo, Peacock and Paramount Plus, among others.

- SiriusXM has figured out how to track audiences across its apps, including Pandora and Stitcher, using a new technology called AudioID. The new identity solution comes from AdsWizz, the digital audio adtech company Pandora acquired in 2018. To work, AudioID matches the data sets of user information across SiriusXM’s businesses, including its own satellite radio music service, as well as streaming apps Pandora and Stitcher. Consumers don’t know this matching is happening on the back-end, nor can they opt-out. But the AudioID itself won’t contain their personal info, it will just be created by matching up that info.

Gaming

Image Credits: Riot Games

- Netflix continued to expand its gaming lineup with the introduction of two more titles. Riot Games’ “Hextech Mayhem,” a League of Legends story, is a Netflix exclusive on mobile, but is also available through other gaming platforms and marketplaces, including Nintendo Switch, Steam and the Epic Games Store, where it’s a paid download of $9.99. It’s also the first major gaming franchise to join the Netflix service. The other new title, “Dungeon Dwarves,” comes from Canadian developer Hyper Hippo, a company founded by Club Penguin co-founder Lance Priebe in 2012.

- Over 500 mobile apps are now using the term “metaverse” in their title or description, hoping to attract new users. After Facebook announced its rebrand to Meta in October, 86 more apps adopted the term in the three months that followed. Many of the apps use other terms too, like crypto, NFTs, AR and VR alongside the word metaverse. A majority of the apps are in the games or finance categories. After the publication of our original article, we got more insight into which companies were at the top of the “metaverse” list. These include: Roblox, IMVU, Play Together, Hotel Hideaway: Virtual World, Granny’s House, Highrise: Social Metaverse App, KuCoin, Binance TR and Gemini.

- Niantic shut down AR game “Harry Potter: Wizards Unite,” a Pokémon GO successor. The game was pulled from the app stores on December 6, 2021, and was officially closed this week, meaning even those who have it installed can now no longer play.

- The App Store booted out the Wordle clones — the popular web-only game just bought by The NYT for a seven-figure sum. But a search for the term on Google Play is another matter. The clones aren’t even trying to pretend they’re unique in some way, using the exact word “wordle” in some cases and featuring its colorful block grid as their avatar. (Google?? What are you doing??)

Dating

- Match Group reported Q4 2021 revenue of $806.1 million, up 24% year-over-year, and net income of $801 million, down from $1.57 billion year-over-year, noting that COVID was still taking a toll on its business, particularly in Asian markets. But the company noted the pandemic pushed it to explore new features, like audio and video, virtual dating, and it’s working on an in-app virtual currency system as well. Relationship-focused app Hinge was a bright spot, with revenue that more than doubled in 2021 to nearly $200 million ahead of a larger global expansion.

- LGBTQ dating app Grindr was pulled from the Apple App Store in China, Bloomberg reported. But the app wasn’t removed by Apple, it turns out — the company itself took its own app down amid an increased internet crackdown. Ahead of the app’s removal, some users had reported connectivity issues when using the service.

Health & Fitness

- Health and fitness apps saw 2.5 billion downloads in 2021, well above pre-COVID levels, App Annie data indicates. The growth was driven in part by demand for well-being, meditation and feminine health products, which drove category downloads up by 25% over 2019.

Utilities

- Google detailed how reviews work on its Google Maps app, noting that once a review is posted it goes to the company’s moderation system, which checks it against policies. Machines are the first line of defense as they can look for patterns that can help to identify the fake and fraudulent content before it’s ever seen. They can also help to identify offensive and off-topic content that could signal a fake review. And the system can look for uncharacteristic activity, like a place getting hit with a number of reviews in a short period of time after being in the news, for example.

Government & Policy

- Apple cut its in-app commissions by a mere 3% following a court order in the Netherlands which forced the company to allow dating apps to have the ability to use third-party payments. But, as in South Korea, Apple isn’t offering a big discount. It’s choosing to charge 27% instead of 30% commission, based on a report of digital sales shared monthly with the tech giant. In another means of discouraging the adoption of alternative payments, developers who want to take advantage of the discount have to submit a separate binary.

- South Korea doesn’t like Apple’s alternative payment plan. The country’s regulators say the plan “still lacks concrete detail” and is reportedly in conversation with the tech giant over the specifics, per Reuters. Apple has said it would continue to charge apps that use alternative payments, but hasn’t said how much. The regulators were also concerned over a similar situation with Google, which only reduced its commission by 4% for apps using third-party payments.

- The Biden administration is moving to revise federal rules to address possible security risks from TikTok and other foreign apps, The WSJ reported, after the conclusion of a public comment period headed by the Commerce Dept. Under the new rule, the commerce secretary could ban foreign apps that were deemed security risks, which could force software like TikTok to submit to third-party monitoring, source code examination and user log monitoring. Though Trump had enacted an executive order to ban TikTok, it hadn’t held up to legal challenges. This new rule is being designed differently with that in mind. The Committee on Foreign Investment in the U.S. also restarted negotiations with TikTok over concerns about Beijing’s access to U.S. users’ personal data. It could lead to a requirement that TikTok’s data is located exclusively in the U.S. and is subject to oversight by trusted national security officials.

Security & Privacy

- The FBI has advised Olympic athletes to leave their personal phones at home when traveling to Beijing and has warned of the risks in using the required health-tracking app and other commonly used apps like digital wallets. The FBI said these apps could be used by attackers to “steal personal information or install tracking tools, malicious code, or malware.”

- A malicious authentication app called 2FA Authenticator was pulled from the Google Play Store after 15 days and over 10,000 downloads. The app was portrayed as a secure authenticator but was actually trying to steal users’ financial information.

- Mozilla updated its mobile and desktop VPN with new privacy features. On Android and iOS, for instance, the app is gaining a multi-hop feature that gives users a little extra privacy while browsing by routing your online activity through an entry VPN server followed by an exit VPN server.

- The Google One VPN service, which has been previously available via the Google Fi cell service, launched on iOS. The service is available to customers of Google One’s premium cloud storage plans (2TB and higher), similar to how Apple now includes Private Relay in its iCloud plans. Members can share their plan and the VPN with up to five family members at no extra cost, no matter whether they’re using an Android or iOS phone.

💰 Challenger bank Mos raised $40 million in Series B funding led by Tiger Global, valuing its business at $400 million, up from $50 million in May 2021. The fintech app began as a tool to connect students with scholarships and grew its community to over 400,000 users before expanding into banking.

💰 Bengaluru-based savings app Jar raised $32 million in Series A funding led by Tiger Global, valuing the business at over $200 million. The new funds come only months after Jar’s seed round. The app, which rounds up transactions and sets money aside as an investment, now has over 4 million users.

💰 Travel experiences app Headout raised another $30 million for its Series B round, again led by Glad Brook Capital. The startup, which helps travelers book tours, attractions and more, had previously raised $15 million in Series B funding. Headout has been EBITDA profitable since last July, despite COVID.

💰 Flip, a chat and HR app for frontline workers, raised $30 million in new funding co-led by Notion Ventures and HV Capital. The company has amassed 200 customers, spanning 1 million end users who use Flip for things like swapping shifts, checking on payslips and more.

💰 Travel booking app Hopper upgraded its valuation to $5 billion after raising $35 million in a secondary share sale. The mobile traveling book app lets users book flights, hotels and cars, and now has over 70 million downloads.

💰 Africa-focused payments startup PalmPay, also the maker of the PalmPartner app, and provider of financial services to consumers and merchants, raised $100 million in Series A funding last August, but had not yet disclosed the investment. The company offers services in Nigeria and Ghana.

💰 Nigerian investment app Bamboo raised $15 million in a Series A round of funding co-led by U.S.-based Greycroft and Tiger Global. The app offers a similar experience to Robinhood and reports having more than 300,000 users, around 20% who are actively trading on a daily basis.

💰 Automated mobile testing service Waldo, which helps companies test their mobile applications, raised $15 million in Series A funding led by Insight Partners. The service runs a live version of apps in a browser window and then records every step of the test, which is triggered directly from CI workflows.

🤝 Meditation app Calm acquired San Francisco-based healthcare tech company Ripple Health Group for an undisclosed sum. Following the acquisition, Ripple Health Group CEO David Ko will take on the role of Calm co-CEO, alongside Michael Acton Smith. Calm co-founder Alex Tew will move from co-CEO to executive chairman.

🤝 French health wearables firm Withings acquired 8fit, makers of a workout and meal planning app backed by $10 million in funding, for an undisclosed sum. The company will integrate 8fit’s offerings into its existing software suite, and said it plans to invest an additional $30 million into building out its connected fitness offerings.

💰 Solana wallet Phantom raised $109 million in Series B funding, led by Paradigm, and launched its iOS app. Other investors in the now-unicorn include a16z, Variant Fund, Jump Capital, DeFi Alliance and Solana Ventures. The startup plans to expand support to other blockchains, including Ethereum.

💰 Seattle-based Stack, offering a crypto app aimed at teens and young adults, raised $500,000 in pre-seed funding from On Deck and Santa Clara Ventures. The gamified platform allows teens to invest in more than 30 cryptocurrency coins by having parents co-own the account if the user is under 18.

💰 New York-based Lunchbox raised $20 million in Series A funding, led by Coatue. The company develops online ordering tools for enterprise restaurant chains and ghost kitchens, acting as the restaurant’s entire digital tech stack for everything from managing orders to apps to loyalty programs.

🤝 Fast-growing livestream shopping app Whatnot “acqui-hired” Pastel Labs for a figure in the range of $5-10 million in an all-stock transaction. The deal allowed the company to bring on board former Pinterest technical lead for growth and well-known growth advisor Jeff Chang to lead its own growth team. The company also hired the former head of Growth and Product Engineering for Lyft, Ludo Antonov, as VP and head of Engineering.

🤝 Free-to-play mobile games publisher Tilting Point acquired a majority stake in Korea-based game developer AN Games, following their partnership to scale the massively multiplayer real-time strategy mobile game Astrokings. The acquisition is Tilting Point’s first since its July 2021 raise of $235 million, and will elevate the company’s presence in the Korean market.

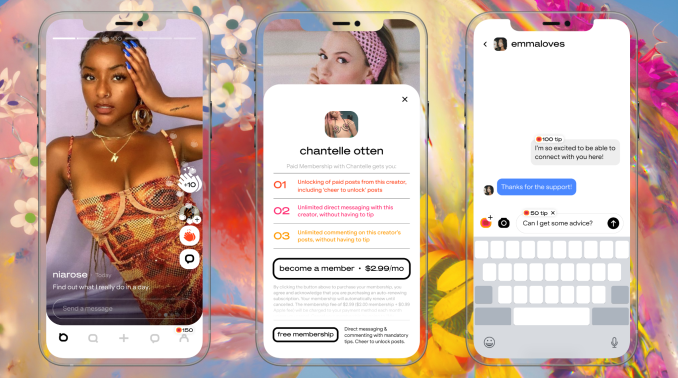

Sunroom

Image Credits: Sunroom

A new creator platform founded by Hinge and Bumble alums, Sunroom (reviewed here on TechCrunch) this week launched its iOS apps aimed at women and non-binary creators. Members who join Sunroom can learn from, connect with and cheer on their favorite creators, as well as help them earn through tipping and subscriptions. The app also features anti-screenshot technology to keep content more private and safe from leaks.